The new financial year starting on April 1, 2025, will be FY 2025-26. When the fiscal year begins new tax laws and adjustments concerning individual tax liabilities and income tax slabs source deduction practices become effective. The Union Budget 2025-26 established new provisions which simplify taxes while improving compliance levels and offering tax relief across various areas. Every taxpayer including salaried individuals and investors together with property owners must understand the financial implications of these recently introduced rules.

Starting from April 1, 2025 the eleven major tax rules for income taxation will be fully implemented.

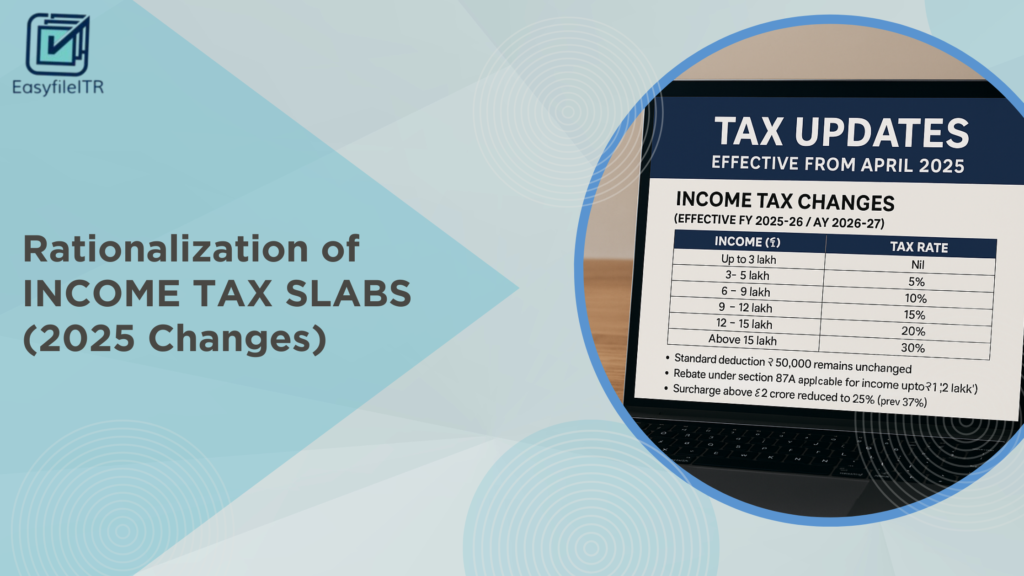

1. New Income Tax Slabs Under the Revised Tax Regime

The Union Budget 2025-26 implements major changes by updating the income tax bracket rules which operate under the new tax system. The tax system moved towards streamlined operation through these changes made to enhance tax administration for individuals.

Annual earnings exceeding ₹24 lakh are subject to India’s maximum tax rate of 30% through the new tax framework. The new income tax slabs represent ongoing government measures to encourage taxpayers to shift from the traditional to the new tax system. People receive reduced taxation through this reform yet they relinquish many formerly allowed exemptions along with deductions.

2. Zero Tax on Income Up to ₹12 Lakh

The new tax regime provides middle-class citizens with a complete tax exemption and tax regime range. Section 87A of the Income Tax Act, 1961 enables a tax rebate for the benefit.

All taxpayers need to submit their Income Tax Return through ITR Filing Services regardless of whether their income falls below ₹12 lakh. Although the rebate eliminates tax obligations it is essential for all taxpayers to fulfill their documentation requirements for filing purposes. The tax authority seeks to promote the new tax system by adding exemptions that will benefit lower-income and middle-class taxpayers.

3. Changes in Taxation of Certain ULIPs

The government has laid out new tax regulations for specific Unit-Linked Insurance Plans (ULIPs) which exceed annual premiums of ₹2.5 lakh.

Starting in FY 2025-26 all ULIP proceeds that do not satisfy Section 10(10D) exemption requirements will become subject to capital gains taxation. The definition of equity-oriented funds applies to these newly categorized gains starting from this financial year.

The taxes on short-term profits from these ULIPs stand at a 20% rate.

Taxpayers will now need to pay a 12.5% tax rate for long-term capital gains since indexation benefits no longer apply to such transactions.

The regulatory changes seek to align ULIP tax rules with mutual fund tax regulations and maintain equal equity market investments for both products. Tax regulations used to be obscure which caused confusion about how taxpayers should be treated by the tax system.

4. Rationalization of TDS Rates and Thresholds

Tax Deducted at Source (TDS) received key changes through provisions introduced within the Union Budget.

a) Reduction in TDS under Section 194LBC:

This taxation section pertains to the payments that securitisation trusts make to their resident investor base. Starting from April 1, 2025 the deduction of tax at source TDS will decrease to 10% for both individual and HUF investors after enforcing a tax rate reduction from 25% for individuals and 30% for others.

b) Increased Thresholds Across Multiple Sections:

The budget regulations elevated TDS thresholds throughout numerous sections that include 193, 194A, 194, 194K, 194B, 194BB, 194D, 194G, 194H, 194-I, 194J, and 194LA. By implementing this move people will have greater disposable income and smaller sum TDS deductions will happen less frequently.

5. Removal of Higher TDS/TCS Rates for Non-Filers

The government has stepped up tax compliance through abolishing Sections 206AB and 206CCA and the corresponding higher TDS and TCS rates that targeted individuals without annual Income Tax Return Filing Services.

Starting in the financial year 2025-2026, all individuals will lose their elevated deduction or collection rate regardless of past individual tax return filings. The government made this change because stakeholder groups presented evidence describing challenges regarding return-filing verification while performing tax deductions or collections.

6. Deduction for NPS Vatsalya Contributions Under Section 80CCD

The Indian government expanded Section 80CCD by incorporating NPS Vatsalya contributions yet restricted this tax benefit to the old tax regime only.

People using the old tax regime have access to additional deductions for their NPS Vatsalya sub-scheme contributions. Additional retirement savings motivation exists with this amendment yet taxpayers maintain the option to select old tax rules.

7. Higher Thresholds for Medical Treatment Perquisites

During the new financial year employees can find tax relief since their medical perquisites keep their tax obligations free. An employer’s payment of overseas medical costs for employee family members or the employee can claim tax deductions with the maximum threshold value now increased.

The tax benefit expansion enables staff members who need expensive healthcare services outside of India.

8. Simplified Calculation of Self-Occupied Property Value

Previous taxation guidelines made the procedure for calculating tax obligations more complex when people owned more than one property. Starting from April 1, 2025, taxpayers can declare zero annual value for their self-while-owned residential properties along with other benefits.

The new rule maintains restrictions on claiming only two properties as self-occupied but provides a benefit by simplifying the process that involves determining deemed rent.

9. Exemption from Prosecution for Delayed TCS Payments

The government provides relief by stating that tax collectors and businesses will not face prosecution regarding TCS (Tax Collected at Source) delays if they pay their amounts before filing their quarterly reports.

The safety feature allows genuine cases of TCS delay as long as the tax gets credited before the designated time limit.

10. Extended Deadline to File Updated Returns

Taxpayers were allowed to submit updated returns within 24 months after their assessment year’s conclusion. The extended filing deadline for updated returns has expanded to 48 months starting from FY 2025-26.

The expanded time limit enables taxpayers to self-correct their ITRs and report extra income without administrative consequences which creates various opportunities for voluntary compliance.

11. Income Tax Department Can Now Compare ITRs for Irregularities

The Income Tax Department now possesses authority to conduct comparisons between present and past income tax returns for detecting inconsistencies and anomalies.

This operational step showcases the department’s implementation of data analytics combined with year-to-year assessment for maintaining income record consistency without specifying the exact comparison standards.

INCOME TAX CHANGES (Effective 1st April 2025 – FY 2025-26/AY 2026-27)

TAX UPDATES

EFFECTIVE FROM APRIL 2025

INCOME TAX CHANGES (EFFECTIVE FY 2025-26/AY

2026-27)

| Revive Range (₹) | Tax Rate |

| 0-4.00,000 | Nil |

| 4-8 lakh | 5% |

| 8-12 lakh | 10% |

| 12-16 lakh | 15% |

| 16-20 lakh | 20% |

| 20-24 Lakh | 25% |

| Above 24 lakh | 30% |

- Rebate under 87A for incomes up to ₹12 lakh (₹60,000 rebate)

- Standard Deduction to ₹75,000 for salaried and pensioners

- There are no tax if your income is below 12 lakh

GST CHANGES (FROM APRIL 2025)

• MANDATORY MULTI-FACTOR AUTHENTICATION (MFA)

• MANDATORY ISD REGISTRATION

• FRESH INVOICE SERIES REQUIREMENT

• MATCHING OF GSTR-1 AND 3B Enhanced if GSTR-1 (sales)

TDS CHANGES (APPLICABLE FROM FY 2025-26)

| Section | Nature | Old Limit | New Limit |

| 194A | Interest(others) | ₹40,000 | ₹50,000 |

| 194I | Interest(seniors | ₹50,000 | 1,00,000 |

| 194H | Rent | 2.4 Lakh | 3 Lakh |

| 194K | Commission | 15,000 | 25,000 |

| 194K | Dividends (MFS) | 5,000 | 10,000 |

• Removal of Sections 206 AB und 206CC A -non-filers of ITR

• TDS on Online Gaming (194BA) continues: 30% on

Conclusion

The new ITR filing services framework starting April 1, 2025 focuses on making payments easier to handle and tax regulations consistent throughout comparable investment vehicles. The new tax regime changes alongside the old one requireapatkan’s comprehensive education to improve financial planning for FY 2025-26.

When deciding tax-related steps you should always ask for expert guidance from professionals or financial advisors who can analyze your situation based on these changes.

Can I still use deductions like 80C or 80D under the new regime?

No. The new tax regime does not allow most deductions and exemptions such as 80C, 80D, HRA, or home loan interest. However, a standard deduction of ₹75,000 is allowed for salaried individuals and pensioners.

What happens to my ULIP tax benefits starting FY 2025-26?

If your ULIP premiums exceed ₹2.5 lakh per year, the maturity proceeds will be taxable.

Can I claim NPS Vatsalya deductions under both tax regimes?

No. The NPS Vatsalya deduction under Section 80CCD is only available in the old tax regime.

What are the new benefits for owning multiple self-occupied properties?

You can now declare up to two properties as self-occupied with zero annual value. This removes the need to calculate deemed rent for the second home, simplifying tax compliance.

Can I revise or update my income tax return if I made a mistake?

Yes. The deadline to file updated returns has been extended from 24 months to 48 months after the end of the assessment year. This provides more time for voluntary corrections without penalties.